Staring at a pile of debt feels less like looking at a spreadsheet and more like looking at a mountain. You know you need to climb it, but you have no idea which path to take.

In the world of personal finance, there are two main trails up that mountain.

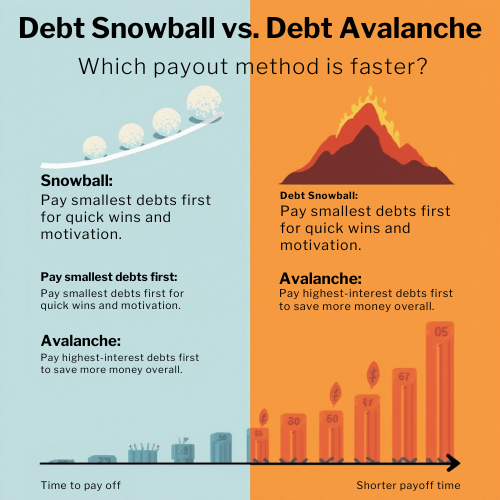

On one side, you have the Debt Snowball: a momentum-based strategy popularized by Dave Ramsey

👉 https://www.ramseysolutions.com/debt/how-the-debt-snowball-method-works

On the other side, you have the Debt Avalanche: a mathematically optimized approach recommended by many financial experts

👉 https://www.investopedia.com/debt-avalanche-method-5188863

For years, math nerds and behavioral psychologists have argued over which is better. The mathematicians scream, “It’s simple math!” The psychologists argue, “Humans aren’t calculators!”

So which one is actually faster? The answer depends on whether you are trying to hack a spreadsheet—or hack your brain.

The Contenders: How They Work

Both methods require you to make minimum payments on all debts except one.

1. Debt Snowball (The Psychological Play)

The Strategy: List debts from smallest balance to largest, ignoring interest rates.

The Goal: Quick wins and motivation.

This approach is backed by behavioral research showing that early success increases follow-through

👉 https://hbr.org/2016/12/research-the-best-way-to-pay-off-your-credit-card-debt

2. Debt Avalanche (The Mathematical Play)

The Strategy: List debts from highest interest rate to lowest.

The Goal: Pay less interest and exit debt faster—on paper.

Consumer finance analysts widely agree this method saves more money over time

👉 https://www.nerdwallet.com/article/finance/debt-avalanche-vs-debt-snowball

Round 1: The Math (Winner: Avalanche)

With credit card APRs averaging 22–24% in 2025, interest is a serious wealth drain

👉 https://www.federalreserve.gov/releases/g19/current/

Attacking the highest-interest debt first minimizes total interest paid and shortens repayment time.

Winner (mathematically): Debt Avalanche

Round 2: The Psychology (Winner: Snowball)

Humans don’t quit because plans are bad—they quit because progress feels invisible.

Research from the Journal of Marketing Research shows that closing accounts (even small ones) dramatically improves success rates

👉 https://journals.sagepub.com/doi/10.1509/jmr.14.0625

Small wins trigger dopamine, reinforcing the habit of repayment.

Winner (behaviorally): Debt Snowball

The Hybrid Strategy (Best of Both Worlds)

Many certified financial planners recommend combining both methods:

- Knock out very small debts first (Snowball)

- Then switch to high-interest balances (Avalanche)

Before starting, build a starter emergency fund so setbacks don’t send you back into debt

👉 https://www.consumerfinance.gov/consumer-tools/savings/

Conclusion: The Best Method Is the One You Finish

- Avalanche is faster on paper

- Snowball is faster in real life for most people

If motivation keeps you moving, choose Snowball.

If optimization keeps you disciplined, choose Avalanche.

Either way, consistency beats perfection.

If your debt feels overwhelming, consider speaking with a nonprofit credit counselor

👉 https://www.nfcc.org/

Your turn: Are you choosing momentum or math?