You open your banking app. You take a deep breath. You look at your credit card bill. Last month, the balance was $4,500. You made a payment of $150. You didn’t buy anything new. Current balance: $4,435.

Wait. You paid $150, but the balance only dropped by $65. Where did the other $85 go? Into the ether? Into the CEO’s pocket? Welcome to the most misunderstood concept in personal finance: APR (Annual Percentage Rate).

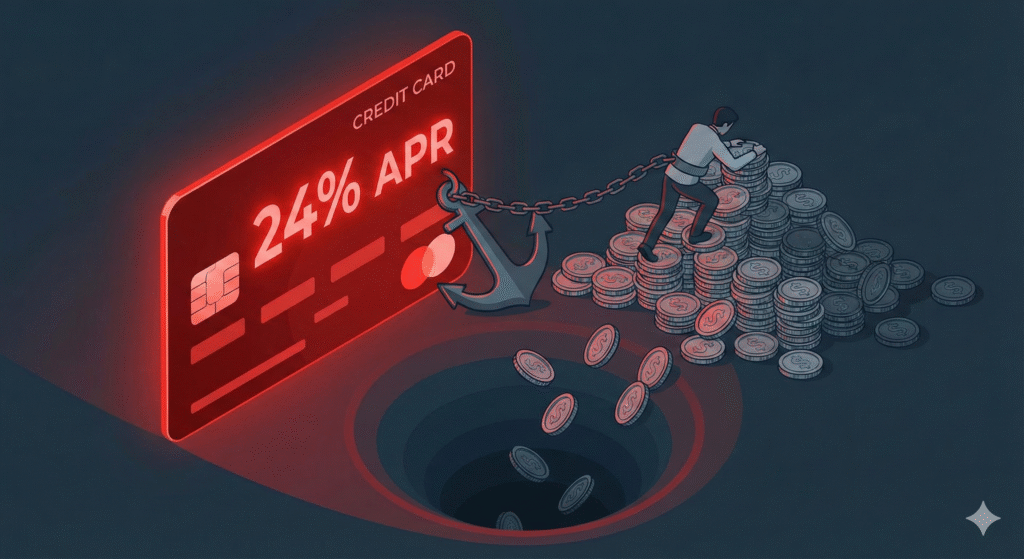

Most people think of debt as a simple subtraction problem: I owe X, I pay Y, now I owe less. But credit card debt is not subtraction; it is exponential multiplication working against you. Banks have designed a system where it is mathematically possible to pay them thousands of dollars over a decade and owe more than you started with.

In this guide, we are going to look under the hood of the credit card engine. We will expose the “Daily Periodic Rate” secret, explain why the “Minimum Payment” is a trap, and give you the mathematical weapons you need to break the cycle.

The “A” in APR is a Lie

The acronym stands for Annual Percentage Rate. This is marketing genius. It makes you think the interest is calculated once a year.

If you have a $1,000 balance at 24% APR, you might assume: “Okay, at the end of the year, they will charge me $240.”

Wrong. Credit card interest is not annual. It is daily.

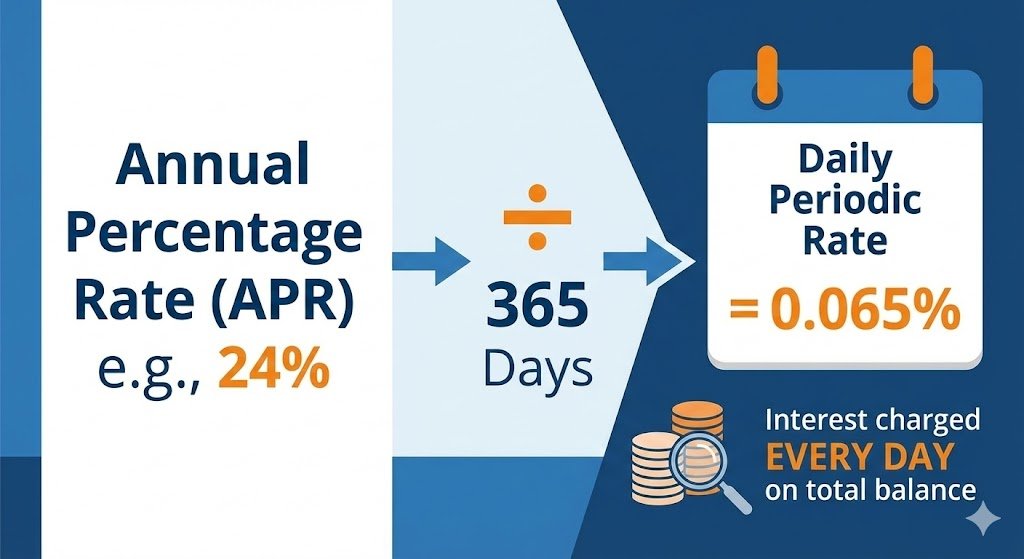

The Secret Number: Daily Periodic Rate (DPR)

To find the real cost of your card, you have to divide your APR by 365.

24% APR ÷ 365 ≈ 0.065% per day.

This sounds tiny. But unlike a mortgage (which uses simple interest), credit card companies use compound interest.

- Day 1: They charge 0.065% on your $1,000. (Balance becomes $1,000.65)

- Day 2: They charge 0.065% on your $1,000.65

- Day 3: They charge 0.065% on your $1,000.13

They are charging you interest on your interest. Every single day you carry a balance, the snowball gets slightly bigger, rolling downhill faster than you can run.

The Trap: How “Minimum Payments” Are Calculated

Have you ever wondered why the minimum payment is such a weird, specific number? It’s rarely a flat $50. It’s usually something like $83.42.

This is not random. It is a formula designed to keep you in debt for as long as legally possible. Most banks calculate your minimum payment using this formula:

Interest + Fees + 1% of the Principal Balance

No matter how huge your payment looks, only 1% of your actual debt is being paid off. The rest of that money—often 60% or 70% of the payment—is just setting fire to the interest that accrued over the last 30 days.

The Case Study: The $10,000 Nightmare

Let’s say you have $10,000 in debt at a standard 24% APR. You decide to stop using the card and just pay the minimum.

| Strategy | Monthly Payment | Time to Pay Off | Total Interest Paid |

|---|---|---|---|

| Minimum Only | Starts at ~$280 | 28 Years | $14,500 |

| Fixed Payment | $400 flat | 3 Years | $3,800 |

If you pay the minimum, you will pay for that debt until 2053. You will pay the bank $14,500 in interest for a $10,000 loan. This is why the finance industry loves minimum payments.

The Hidden Ghost: “Trailing Interest”

Here is a scenario that drives people crazy. You finally save up enough cash. You pay off your full $2,000 balance to zero. You celebrate!

Next month, you get a bill for $14.

“But I paid it off!” you scream.

This is called Trailing Interest (or Residual Interest). Because interest is calculated daily, there is a lag between when your bill is sent and when your payment arrives.

- Bill Sent: Jan 1st ($2,000 balance)

- Payment Made: Jan 15th

Even though you paid the “Full Balance” listed on the Jan 1st statement, you still owe the interest that accrued from Jan 1st to Jan 15th.

Pro Tip: If you want to kill a balance for good, check your app for the “Payoff Quote” (not the Current Balance). The Payoff Quote includes the trailing interest up to today.

How to Beat the Math (Your Escape Plan)

Now that you understand the game is rigged, how do you win? You cannot math your way out of high-interest debt with minimum payments. You need a strategy.

1. The Avalanche Method (The Mathematical Win)

Since APR is the enemy, kill the highest APR first.

- List all your debts.

- Sort them by interest rate (Highest to Lowest).

- Pay minimums on everything else, and throw every spare dollar at the card with the highest APR.

Why: This stops the compound interest bleeding fastest. Learn more about the Avalanche vs Snowball method.

2. The Balance Transfer (The “Time Out” Button)

If you have decent credit (usually 670+), you can apply for a 0% APR Balance Transfer Card (like Wells Fargo Reflect or Citi Simplicity).

- The Move: Transfer your $5,000 debt from a 24% APR card to the new card.

- The Benefit: For 12–21 months, the interest stops completely. 100% of your payment goes to the principal.

- The Catch: There is usually a 3%–5% transfer fee. Paying a one-time 3% fee is mathematically superior to paying 24% APR for a year.

3. The Personal Loan Swap

If you can’t get a balance transfer card, look at a Personal Loan.

- The Move: Take out a loan at 10% interest. Use it to pay off the credit card at 24% interest.

- The Benefit: You instantly cut your interest rate in half, and personal loans have a fixed end date (usually 3 or 5 years). You must pay it off; you can’t stay in the minimum payment trap.

Conclusion: Stop Leasing Your Lifestyle

Credit card debt is essentially renting your past choices at a premium price. That dinner you ate three years ago? If you are paying minimums, you are still paying for it today—and it cost you double the menu price.

Understanding APR is the red pill of personal finance. Once you see the “Daily Periodic Rate” and the “1% Principal Rule,” you realize that carrying a balance isn’t a tool; it’s an emergency.

Your Action Item for Today:

- Log in to your credit card account. Find the APR (it’s usually hidden on the last page of your PDF statement).

- Calculate your Daily Rate (APR ÷ 365).

- Set up an automatic payment for $20 more than the minimum. Even that tiny increase can shave years off your payoff date.

Are you currently battling high-interest debt? Which method are you using—Avalanche or Snowball? Let us know in the comments!

Disclaimer: This content is for educational purposes only. Interest rates and formulas can vary by issuer. Always read your Cardholder Agreement for exact terms.