We are raised to believe that “The Bank” is a pillar of stability. You get a job, you walk into the massive stone building downtown with the serious-looking logo, and you hand them your money.

But have you ever stopped to ask who that bank is actually working for?

In the world of personal finance, there is a dirty little secret: traditional banks are legally obligated to maximize profits for their shareholders, not their customers. According to the U.S. Securities and Exchange Commission, publicly traded banks must prioritize shareholder value. Every time they charge you a $35 overdraft fee or pay you 0.01% interest on your savings, their stock price benefits—not you.

But there is an alternative. A financial system where you are the shareholder. Where profits don’t flow to Wall Street but are reinvested back into your community.

It’s called a credit union.

In 2025, the gap between small local credit unions and massive mega-banks has narrowed significantly. Many now offer competitive apps, nationwide ATM access, and better rates. If you’re still banking with a national giant, you may be voluntarily overpaying for your mortgage, your car loan, and everyday banking. Let’s break down why switching could be one of the smartest money moves you haven’t made yet.

The Core Difference: “Members” vs. “Customers”

To understand why credit unions consistently save people money, you have to follow the money.

Traditional Banks (For-Profit)

Banks like Chase, Wells Fargo, or Bank of America operate as for-profit corporations.

- The boss: Shareholders and institutional investors

- The goal: Maximize profit margins

- The result: Higher fees, lower savings rates

The Federal Deposit Insurance Corporation (FDIC) reports that large banks generate billions annually from overdraft and service fees alone.

Credit Unions (Not-for-Profit)

Credit unions are member-owned financial cooperatives regulated by the National Credit Union Administration (NCUA).

- The boss: You (the member-owner)

- The goal: Financial well-being of members

- The result: Lower loan rates, fewer fees, higher savings yields

Unique insight: Think of a bank like renting an apartment—you pay the landlord. A credit union is like owning a condo—you share in the value.

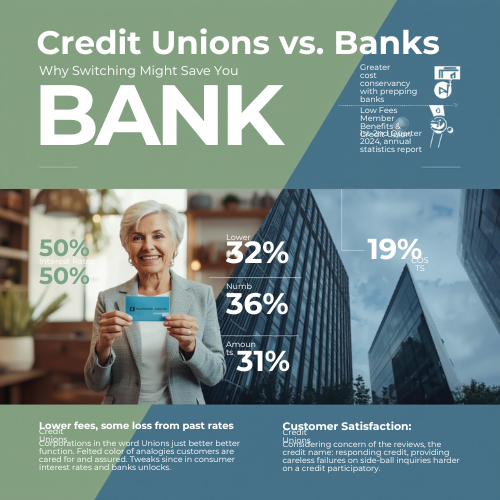

The Financial Impact: Show Me the Numbers

It’s easy to say credit unions are “nicer,” but do they actually save you money?

According to the Credit Union National Association (CUNA), credit union members saved over $13 billion annually compared to traditional banks.

1. Loan Rates (Where You Save Thousands)

Because credit unions operate without profit pressure, they consistently offer lower loan rates.

- Auto loans: Credit unions average 1–2% lower APR than banks. On a $30,000 loan, that can save nearly $1,000 over five years.

- Personal loans: Credit unions often undercut online lenders and big banks on unsecured debt.

(Source: NCUA Consumer Data)

2. Fees (The “Gotcha” Protection)

As discussed in our guide on avoiding hidden bank fees, service charges quietly drain accounts at large banks.

- Checking accounts: Over 75% of credit unions offer $0 monthly fees, according to CUNA

- Overdraft fees: Many credit unions charge $20–$25 instead of the $35 industry average—and some waive the first incident entirely

3. Savings Rates

While online-only banks may offer the highest yields, credit unions still outperform traditional banks significantly.

The NCUA reports that credit union savings rates are typically 5–10x higher than those offered by large brick-and-mortar banks.

The Myth of Convenience: “But They Don’t Have ATMs!”

This is the most common reason people stick with big banks—and in 2025, it’s outdated.

Most credit unions belong to the CO-OP Shared Branching Network, which allows members to use thousands of shared locations nationwide.

- Over 30,000 surcharge-free ATMs, according to CO-OP Financial Services

- More ATMs than Chase or Bank of America

- Deposit checks and withdraw cash at partner credit unions nationwide

You can open an account in Ohio and deposit money in Florida without paying a fee.

Credit Unions vs. Banks: Quick Comparison

Note: Many credit unions have flexible membership rules. Living in a certain county or making a small charitable donation often qualifies you.

| Feature | Credit Unions | Big Banks |

|---|---|---|

| Ownership | Member-owned | Shareholder-owned |

| Monthly fees | Rare | Common |

| Loan rates | Lower | Higher |

| ATM access | 30,000+ shared | Bank-specific |

| Profit use | Returned to members | Paid to investors |

When a Big Bank Might Make Sense

To stay balanced, there are a few situations where big banks can be useful:

- Frequent international travel: Larger global networks and smoother foreign transactions

- Advanced financial tools: Integrated investing, complex business wires, or corporate accounts

For everyday needs—checking, saving, auto loans, and personal finance—credit unions win for most people.

Conclusion: Vote With Your Wallet

Switching banks feels inconvenient. You have to move direct deposits, update subscriptions, and learn a new app.

But ask yourself: How much is your loyalty costing you?

If you’re paying $12 a month in fees and 7% on a car loan when you could be paying 5%, that loyalty may be costing you hundreds or thousands per year.

Your Action Plan:

- Use the NCUA Credit Union Locator

- Check membership eligibility (it’s usually easier than expected)

- Open a savings account with a small deposit to get started

Have you ever banked with a credit union? Did you notice the difference? Share your experience in the comments.

Disclaimer: Financial data reflects 2024–2025 averages. Rates and policies vary by institution. Always verify current terms directly.