Finance is different when you have options. Ten thousand dollars is a magic number in personal finance. It’s the difference between panicking when your car breaks down and simply swiping your card. It’s a down payment on a house, a year of tuition, and the “Forget You” money that lets you walk away from a toxic job.

But when you’re staring at a bank account with two digits, saving $10,000 feels like climbing Everest without oxygen. You think, “I don’t make enough money” or “My rent is too high.”

Here’s the truth: saving $10,000 isn’t about luck—it’s a finance math problem, and unlike calculus, this math is simple.

In this guide, we ignore generic advice like “stop buying lattes.” Instead, we build a tactical, aggressive plan to earn, protect, and grow money over the next 365 days.

Phase 1: The Finance Math (It’s Less Than You Think)

To save $10,000 in one year, you need to save:

- $833.33 per month

- $192.30 per week

- $27.40 per day

From a finance perspective, this is realistic. According to budgeting research from Investopedia, breaking large savings goals into daily or weekly targets significantly increases success rates.

👉 Source: https://www.investopedia.com/personal-finance-budgeting-basics-4689732/

Phase 2: Defense – Stop the Money Leaks

Strong personal finance starts by stopping unnecessary spending.

1. Subscription Audit

We live in the subscription economy. Streaming services, apps, and memberships quietly drain cash. A study by Rocket Money found that the average person wastes over $30 per month on unused subscriptions.

👉 Source: https://www.rocketmoney.com/learn/personal-finance/subscription-statistics

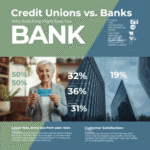

2. Kill Hidden Bank Fees

Banks profit from overdrafts and maintenance fees. According to the Consumer Financial Protection Bureau (CFPB), Americans lose billions yearly to overdraft charges alone.

👉 Source: https://www.consumerfinance.gov/about-us/blog/overdraft-and-nsf-fees/

Switching to a fee-free account is one of the easiest finance wins you can make.

3. The 24-Hour Rule

Behavioral finance studies from Harvard Business Review show delayed purchasing dramatically reduces impulse spending.

👉 Source: https://hbr.org/2018/01/a-simple-way-to-reduce-impulse-buying

Phase 3: Offense – Increase Income (Finance Has No Ceiling)

Cutting expenses has limits. Income doesn’t. Improving your financial situation requires earning more.

Proven Side Hustles

- Freelancing (writing, design, coding):

Platforms like Upwork and Fiverr connect freelancers with global clients.

👉 https://www.upwork.com

👉 https://www.fiverr.com - Reselling & Flipping:

Many sellers earn consistent income through eBay and Facebook Marketplace.

👉 https://www.ebay.com - Gig Economy:

Apps like Uber and DoorDash provide fast, flexible income.

👉 https://www.uber.com

👉 https://www.doordash.com

According to Bankrate, side hustles now contribute up to 25% of income for many adults.

👉 Source: https://www.bankrate.com/banking/savings/side-hustle-statistics/

Phase 4: The Finance System That Makes Saving Automatic

1. High-Yield Savings Accounts (HYSA)

Keeping money in checking accounts kills growth. High-yield savings accounts pay up to 5% APY, according to NerdWallet and Bankrate.

👉 https://www.nerdwallet.com/best/banking/high-yield-online-savings-accounts

👉 https://www.bankrate.com/banking/savings/best-high-yield-savings-accounts/

2. Pay Yourself First

Automating savings is a core personal finance principle recommended by Forbes and The Balance.

👉 https://www.forbes.com/advisor/banking/savings/pay-yourself-first/

👉 https://www.thebalancemoney.com/pay-yourself-first-2385962

Conclusion: Finance Is Freedom

Finance isn’t about restriction—it’s about control. One year from today, seeing $10,000 in your account means freedom, security, and confidence.

According to Psychology Today, financial stability is one of the strongest predictors of reduced stress and better mental health.

👉 Source: https://www.psychologytoday.com/us/basics/money/financial-stress

Say no today so you can say yes later.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Always verify information with official financial institutions.